signal strength 1 of 5

According to the chart of M5, USDCHF formed the Inverse Head and Shoulder pattern. The Head’s top is set at 0.8148 while the median line of the Neck is found at 0.8120/0.8140. The formation of the Inverse Head and Shoulder pattern evidently signals a reversal of the downward trend. In other words, in case the scenario comes true, the price of USDCHF will go towards 0.8163

The M5 and M15 time frames may have more false entry points.

ดูเพิ่มเติม

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

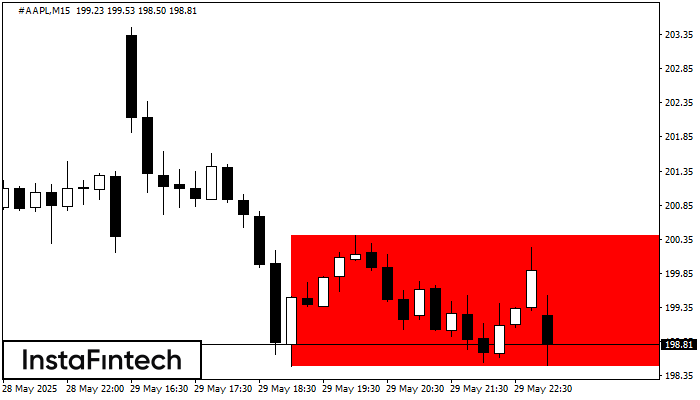

According to the chart of M15, #AAPL formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 200.40, the lower border is 198.49. The signal means

The M5 and M15 time frames may have more false entry points.

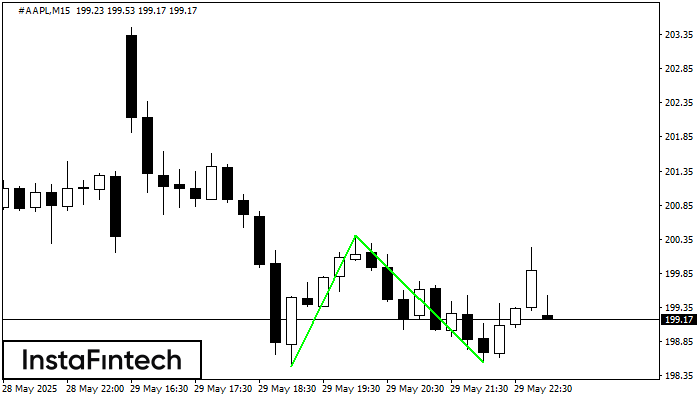

Открыть график инструмента в новом окнеThe Double Bottom pattern has been formed on #AAPL M15. Characteristics: the support level 198.49; the resistance level 200.40; the width of the pattern 191 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

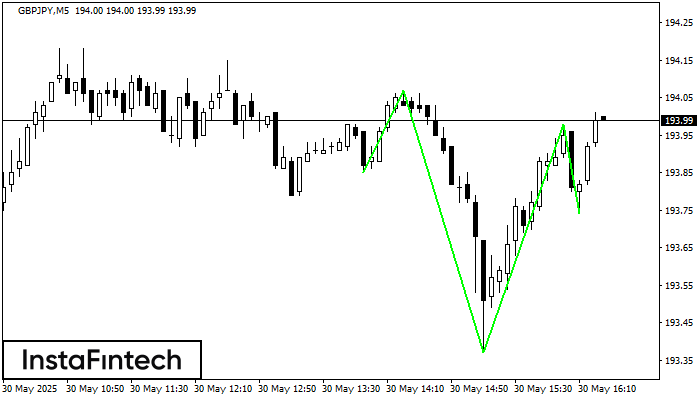

Открыть график инструмента в новом окнеAccording to M5, GBPJPY is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 194.07/193.98 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне