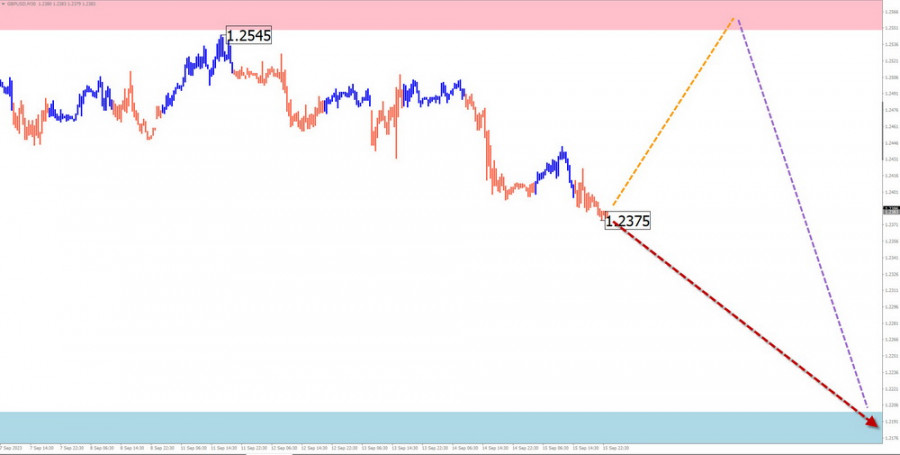

GBP/USD

Brief analysis:

The price trend direction of the main British pound pair has been set by a descending wave algorithm since July of this year. The daily timeframe chart shows the corrective nature of this movement. The structure is missing a final segment.

Forecast for the week:

The upcoming week is expected to continue the overall downward trend of the British pound. In the first few days, a short-term price rebound upward, not exceeding the upper resistance boundary, is not excluded. Support runs along the upper level of the current wave's preliminary target zone.

Potential Reversal Zones

Resistance:

Support:

Recommendations

Buy: High risk, may result in losses.

Sell: If corresponding signals from your trading system appear, they may become the main direction for trading.

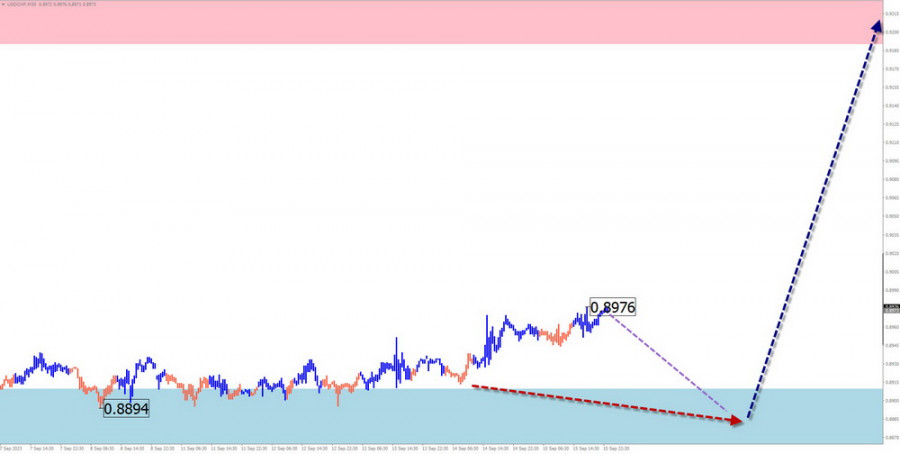

AUD/USD

Brief analysis:

The descending wave zigzag, which started in February, brought the Aussie quotes to a powerful potential reversal zone. The wave structure was not fully formed at the time of analysis. The ongoing wave segment begins on July 14th. Recently, a corrective flat has been forming within the wave structure.

Forecast for the week:

At the beginning of the upcoming week, an upward vector is more likely, with a flat character of movement. In the second half of the week, the probability of a reversal and the resumption of the price decline increased from the resistance zone.

Potential Reversal Zones

Resistance:

Support:

Recommendations

Buy: Can be used with reduced trading volume within separate sessions. The potential is limited by resistance.

Sell: Will become relevant after confirmed reversal signals appear in the resistance zone.

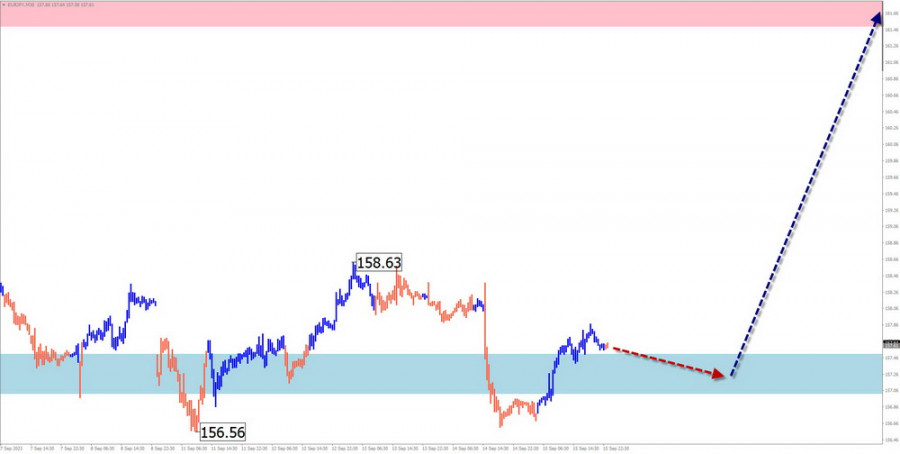

USD/CHF

Brief analysis:

After the bearish wave that ended in mid-July, the price trend of the major Swiss franc pair is defined by a bullish wave. Its high potential suggests the transition of the entire movement to the daily timeframe. Last week, the quotes broke through intermediate resistance.

Forecast for the week:

The upcoming week is expected to be similar to the previous periods. After a likely move in the first few days along the support boundaries, we can expect a resumption of price growth. The calculated resistance demonstrates the maximum range of price increases.

Potential Reversal Zones

Resistance:

Support:

Recommendations

Selling: High risk, low potential.

Buying: After signals from your trading system appear in the support zone, they may become the primary direction for trading.

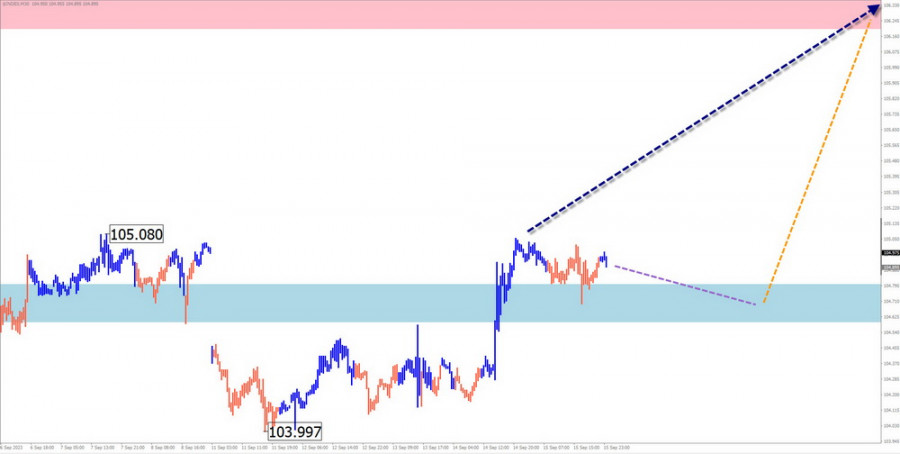

EUR/JPY

Brief analysis:

Over the past three years, the euro/yen cross rates have consistently moved north on the price chart. The current short-term unfinished wave counts from the end of July. Over the last four weeks, the price has mainly moved sideways, forming a correction. The ascending segment of the movement since September 14th has reversal potential. If confirmed, it will mark the beginning of the main wave's final part (C).

Forecast for the week:

A short-term sideways movement along the support boundaries is included in the next few days. By mid-week, the probability of increased volatility, a change in direction, and the start of active price growth increases.

Potential Reversal Zones

Resistance:

Support:

Recommendations

Selling: No conditions for trades.

Buying: This can be used for trading after signals in the support zone are confirmed by your trading system.

EUR/CHF

Brief analysis:

The trend direction of the euro/Swiss franc cross rates has been a descending wave since the beginning of the year. Since the end of July, a corrective flat has formed in the structure, squeezed into a narrow corridor between the ninety-seventh and ninety-fifth price figures.

Forecast for the week:

The upcoming week will continue the overall sideways mood of the cross's price movement. In the first half, an ascending vector is more likely. A reversal and the beginning of a decline towards the lower boundary can be expected closer to the end of the week.

Potential Reversal Zones

Resistance:

Support:

Recommendations

Buying: Possible with a reduced lot size for intraday trading.

Selling: This may be used for trading from the resistance zone after corresponding signals appear on your trading system.

US Dollar Index

Brief analysis:

The prolonged period of weakening the US dollar's positions since a strengthening trend has replaced mid-July. It's worth noting that this wave serves as a correction to the previous trend segment on the daily timeframe chart. After breaking through the next resistance, the dollar's quotes consolidate above it.

Forecast for the week:

In the first half of the upcoming week, a sideways movement along the support boundaries can be expected. Activity and a resumption of growth are more likely towards the end of the week. Any economic data news can serve as a trigger.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Selling the US dollar in major pairs needs more potential. It is wiser to maintain bearish positions in major currencies.

Explanation: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). Only the last unfinished wave is analyzed in each timeframe. Dotted lines indicate expected movements.

Attention: The wave algorithm does not consider the duration of instrument movements over time!