signal strength 2 of 5

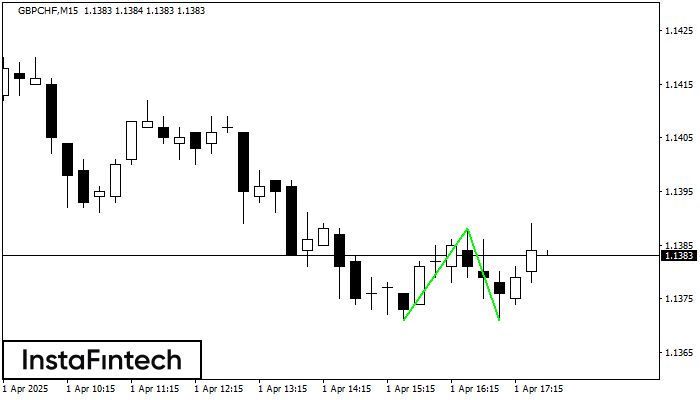

The Double Bottom pattern has been formed on GBPCHF M15. Characteristics: the support level 1.1371; the resistance level 1.1388; the width of the pattern 17 points. If the resistance level is broken, a change in the trend can be predicted with the first target point lying at the distance of 17 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

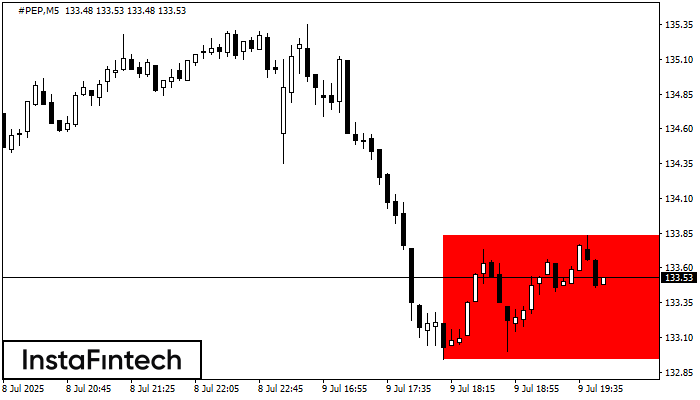

Theo biểu đồ của M5, #PEP đã tạo thành Hình chữ nhật giảm. Loại mô hình này cho thấy sự tiếp tục xu hướng

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

Open chart in a new windowTheo biểu đồ của M5, #PEP đã tạo thành Hình chữ nhật giảm. Mô hình này cho thấy sự tiếp tục của xu hướng. Đường viền trên là 133.83, đường

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

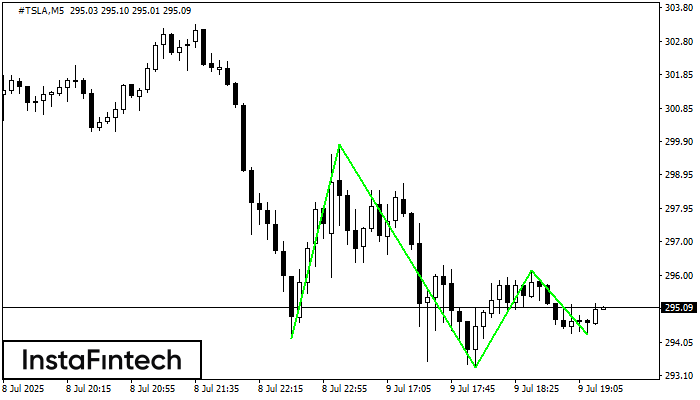

Open chart in a new windowMô hình Đáy ba đã được hình thành trên biểu đồ của #TSLA M5. Các tính năng của mô hình: Đường dưới của mô hình có tọa độ 299.81

Khung thời gian M5 và M15 có thể có nhiều điểm vào lệnh sai hơn.

Open chart in a new window