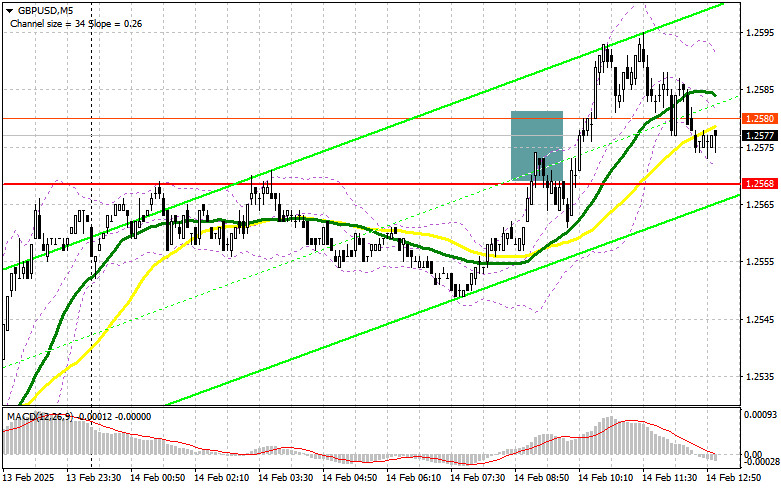

In my morning forecast, I focused on the 1.2568 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A rise and the formation of a false breakout around 1.2568 provided a good entry point for selling the pound, but a significant decline did not materialize, leading to loss fixation. The technical outlook for the second half of the day has been revised.

To Open Long Positions on GBP/USD:

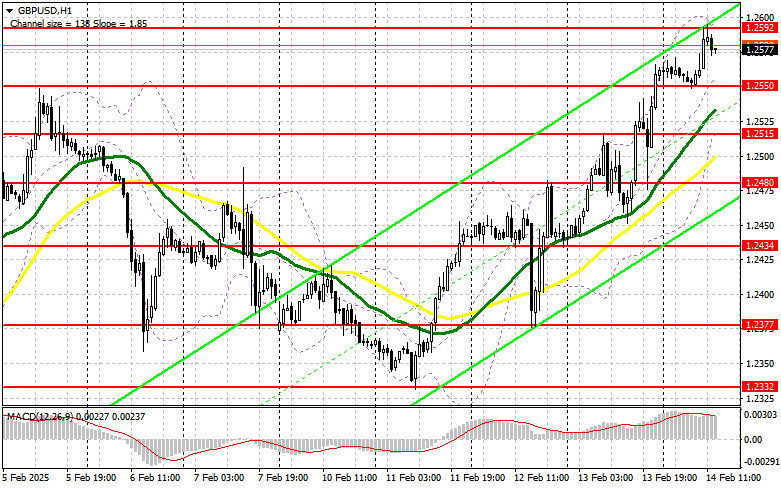

The pound continued its upward movement, supported by demand that remained in the market since the second half of yesterday's session, following news that Trump does not intend to apply trade tariffs aggressively.

In the second half of the day, we expect retail sales and industrial production data from the U.S. for January. If the figures disappoint, this could increase pressure on the dollar and trigger another wave of pound growth. Additionally, FOMC member Lorie K. Logan's speech will be in focus.

If economic indicators improve, pressure on the pound will return, forcing buyers to defend support at 1.2550. I will only open long positions after a false breakout at this level, targeting a rise to 1.2592, a resistance formed in the first half of the day. A breakout and retest of this range from above will provide a new entry point for long positions, aiming for 1.2630, which would strengthen the bullish outlook. The furthest target will be the 1.2664 level, where I will lock in profits.

If GBP/USD declines and buyers show no activity at 1.2550 in the second half of the day, it won't be critical, but pressure on the pound could increase toward the end of the week. In this case, I will only consider long positions after a false breakout around the 1.2515 low. I plan to buy GBP/USD immediately on a rebound from 1.2480, targeting an intraday correction of 30-35 points.

To Open Short Positions on GBP/USD:

Pound sellers attempted to enter the market but did so very cautiously. There are currently no strong reasons to sell GBP/USD, but profit-taking ahead of the weekend could create opportunities. I will look to take advantage of this scenario.

A false breakout around the new resistance at 1.2592, similar to the earlier scenario, will provide an entry point for short positions, targeting a drop to 1.2550, where the moving averages, which favor buyers, are slightly below. A breakout and retest of this level from below will trigger stop-loss orders and open the path to 1.2515. The furthest target will be 1.2480, where I will lock in profits.

If demand for the pound remains strong in the second half of the day after weak U.S. retail sales data, and bears fail to act at 1.2592, the pair will continue to rise. In this case, it's better to postpone selling until the next resistance test at 1.2630. I will enter short positions only after a failed breakout attempt. If no downward movement occurs even at that level, I will look for short positions on a rebound from 1.2664, targeting a correction of 30-35 points.

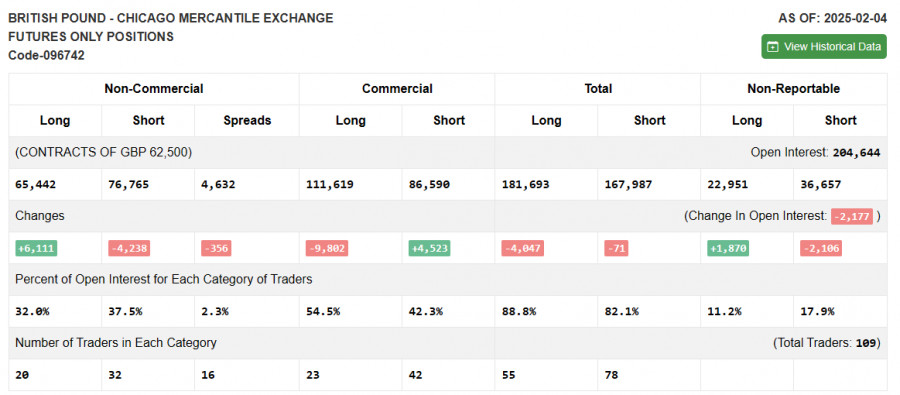

Commitments of Traders (COT) Report:

The COT report for February 4 showed a reduction in short positions and an increase in long positions. However, it is too early to conclude that the pound is set for growth. The report does not yet reflect the Bank of England's decision to cut interest rates and adopt a much more dovish stance than before.

The recent rally in the pound was merely a correction, while fundamental pressure on the pair remains. Additionally, new measures from the U.S. administration will continue to weigh on risk assets while maintaining strong demand for the dollar.

The latest COT report indicates that non-commercial long positions increased by 6,111 to 65,442, while short non-commercial positions fell by 4,238 to 76,765. As a result, the spread between long and short positions narrowed by 356 contracts.

Indicator Signals:

Moving Averages:The pair is trading above the 30- and 50-day moving averages, indicating further pound growth.

Bollinger Bands:If the pair declines, the lower boundary of the indicator around 1.2515 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise.

- 50-period MA (yellow on the chart).

- 30-period MA (green on the chart).

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period.

- Slow EMA – 26-period.

- SMA – 9-period.

- Bollinger Bands: 20-period.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: The total long open positions held by non-commercial traders.

- Short non-commercial positions: The total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.