GBP/USD

Brief Analysis:

The short-term trend of the British pound has been determined by a bearish wave since mid-summer. The structure initiated the intermediate part (B) on October 4. The downward segment from November 6 has a reversal potential. Quotes are within the potential reversal zone on a weekly scale. Before continuing the trend, the price needs to be corrected.

Weekly Forecast:

The beginning of the upcoming week is expected to be flat. Price movements of the pound are likely to be in a sideways range along the resistance zone. Subsequently, a downward vector can be expected. The calculated support is located at the accumulation of potential reversal zones of different scales.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Sales: Possible with a fractional lot in separate sessions after signals from your trading system near the resistance zone appear.

Purchases: Not recommended until the completion of the upcoming correction.

AUD/USD

Brief Analysis:

Within the dominant bearish trend, the quotes of the Australian dollar have been forming a corrective segment since October. Its magnitude does not exceed the correction level of the last part of the main wave. The downward segment from November 6 has a reversal potential. Upon confirmation, it will begin a new part of the main trend.

Weekly Forecast:

A sideways price vector is probable at the beginning of the upcoming week. Short-term growth is possible within the calculated support boundaries. Increased volatility and a resumption of downward price movement can be expected closer to the weekend. The support level demonstrates the lower boundary of the expected weekly range.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Purchases: Risky. Due to the limited upward potential, there is a high probability of deposit loss.

Sales: This will become relevant after the appearance of corresponding signals in your used trading systems near the resistance zone.

USD/CHF

Brief Analysis:

The analysis of the daily chart of the Swiss Franc shows the formation of a downward wave since November. Since July 14, the price has been correcting upward towards the main movement. The structure of this wave needs to be completed. The nearest target is the preliminary target zone, the upper limit indicated by the level of calculated support.

Weekly Forecast:

The pair's price is expected to decline throughout the current week, reaching the support zone. At the beginning of the week, a short-term price rollback upward to the resistance zone is not ruled out. The greatest activity can be expected in the second half of the week.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Purchases: Not relevant in the coming days.

Sales: This can be used for trading after the appearance of confirmed signals in the resistance zone.

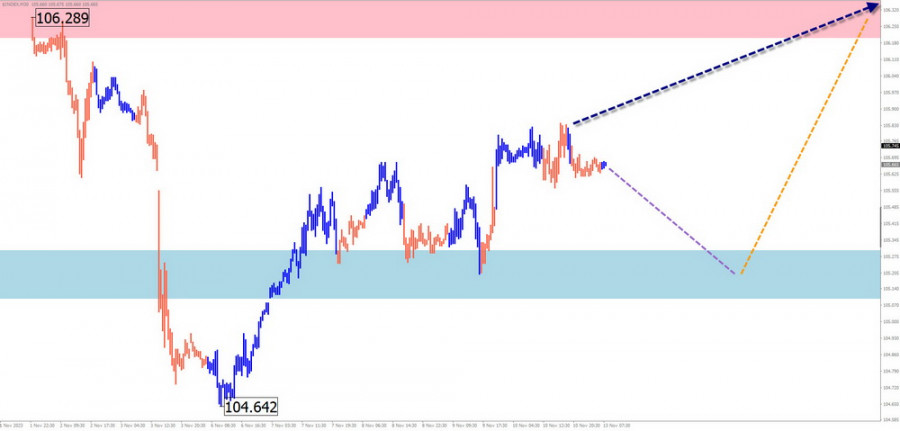

EUR/JPY

Brief Analysis:

The unfinished wave structure of the euro against the Japanese yen's chart is directed upward and has been counting since July 28. Since the beginning of last month, the price has been forming the final part of the wave (C). The wave structure needs to look complete. Quotes are approaching the upper limit of the potential reversal zone on a weekly timeframe.

Weekly Forecast:

In the next couple of days, one can expect the continuation of the pair's price increase. A breakthrough beyond the resistance zone is unlikely. Towards the end of the week, against the backdrop of increased volatility, a change in direction and a resumption of price decline are expected. The calculated support indicates the lower boundary of the expected weekly range.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Sales: Will become relevant after the appearance of reversal signals in your trading systems in the resistance zone.

Purchases: Can be used with a fractional lot in separate trading sessions.

AUD/JPY

Brief Analysis:

A flat price movement has been observed in recent months on the chart of the Australian Dollar against the Japanese yen. The unfinished wave structure has been downward since June 16. In its structure, the intermediate part (B) is approaching completion. The price is at the lower boundary of a strong resistance. There are no signals of an imminent reversal on the chart.

Weekly Forecast:

In the next few days, the most likely scenario will be an attempt to exert pressure on the resistance zone. Subsequently, one can expect a change in direction and the course of the cross towards the calculated support.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Sales: This will become relevant after confirmed reversal signals appear in the resistance zone.

Purchases: The potential is limited by resistance. Transactions may become unprofitable.

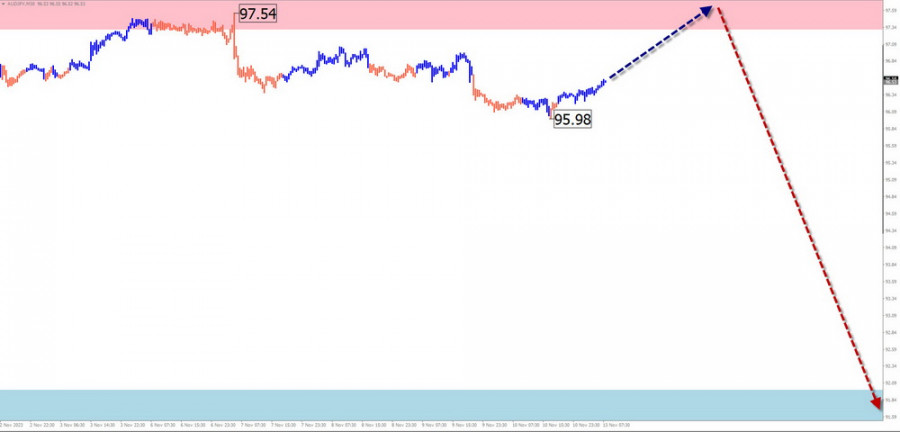

US Dollar Index

Brief Analysis:

The quotes of the US Dollar have been regaining lost positions since mid-July. In the area of strong resistance, the price has been forming an upward correction since the beginning of October. Its structure looks completed at the time of the analysis. The upward segment from November 6 has a reversal potential. Upon confirmation, it will mark the beginning of the final part of the wave (C).

Weekly Forecast:

The index quotes may decline in the next few days, reaching the calculated support. After that, a sideways movement along its boundaries is expected to form a reversal and a rollback of upward index values. The limiting zone of the rise is the calculated resistance.

Potential Reversal Zones:

Resistance:

Support:

Recommendations:

Sales: Selling currencies in major pairs may be possible with a reduced lot in separate trading sessions.

Purchases: Purchases of national currencies will become relevant after the completion of the upcoming correction of the dollar index.

Note: In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed on each timeframe. Dashed lines indicate expected movements.

Attention: The wave algorithm does not consider the duration of instrument movements over time!