Markets continue to win back Federal Reserve Chairman Jerome Powell's comments, which caused a wave of profit taking on speculative trading positions. The dollar retreated for a while, but dollar bulls were active again during the U.S. session. What does this mean? Should we wait for the dollar to recover or is this the last spurt before the beginning of a long capitulation?

The Fed has been shaking up the markets lately. It is possible that it is preparing them for the forthcoming easing of monetary conditions. There is reason to believe that the central bank will cut rates more sharply than other major central banks.

In that case, we are dealing with the beginning of a prolonged downtrend for the greenback. The dollar index may still go up, but not much and not for long.

The depreciation of the dollar is expected to occur gradually, as the economy goes into recession, and the Fed is trying to choose the best time to start cutting rates.

The rate of the dollar's decline should intensify in 2024, while a sharp downward movement is not expected. Moreover, market players are constantly changing their opinions about the U.S. monetary policy. Naturally, it has its reasons. The mixed dynamics on all fronts potentially reflects continued uncertainty as to whether the Fed can achieve its 2% inflation target without hurting a robust labor market and a robust economy.

Such a scenario has merit. At least Powell has confirmed such a possibility.

It is clear that a sharp decline from the dollar is expected in the long term. In the short-term, however, the picture looks somewhat different.

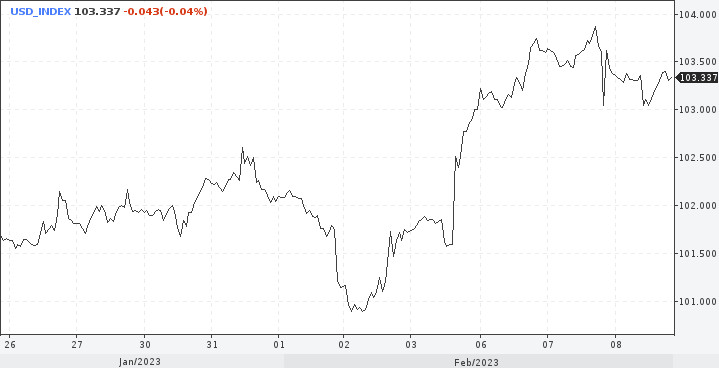

The dollar index has lost momentum, but bullish attempts are still possible. Bulls are facing a serious obstacle at 104.00.

However, as long as the indicator stays above 102.00, further growth is possible. To ensure such movement, the bulls must overcome the February high at 103.96. Then it can continue to rise to 105.63, the 2023 high.

Important points for traders

Powell's comments at the Washington Economic Club meeting were important given the release of strong labor market data after the Fed meeting. Traders and investors mostly focused on Powell's speech, which, by the way, was more like an interview.

There were a lot of interesting questions from third parties. Here are a few key talking points.

Did the market interpret February's policy decision wrong?

"What we said at the meeting was that ongoing rate increases will be appropriate. And the reason is we're trying to achieve a stance of policy that is sufficiently restrictive to bring inflation down to 2% over time, and we don't think we've achieved that yet. So we said that. And I, and you know, now you see the labor market report and I think again, financial conditions are now more well aligned with that than they were before."

Why is the labor market so strong?

"Well, the labor market is strong because the economy is strong and, as I mentioned, it's a good thing that we've been able to see the beginnings of disinflation without seeing the labor market weaken. There's a lot of demand for workers. In fact, if you look at the supply of workers versus demand for workers, demand for US workers is now more than 5 million greater than the available supply and the available supply consists."

Are the markets getting the interest rate forecast right?

"So we never say this is what we think will happen. We, you know, we make a tentative forecast and then we let the data come in. For example, if the data were to continue to come in stronger than we forecast. And we were to conclude that we needed to raise rates more than is priced into the markets or than we wrote down at our last group forecast in December. Then we would certainly do that. We would certainly raise rates more."

The Fed has given the most ground to ponder at least until next week's U.S. inflation figure is released. Perhaps that data will turn things upside down again. In the meantime, markets will be more patient with further monetary policy predictions. Most likely, a more hawkish approach will have to be rearranged.

The Fed is unlikely to move away from tightening so quickly. The May meeting could once again end with a 25 bps hike, though market players are tuned in at 0.05. We will have to readjust. Probably more than once.

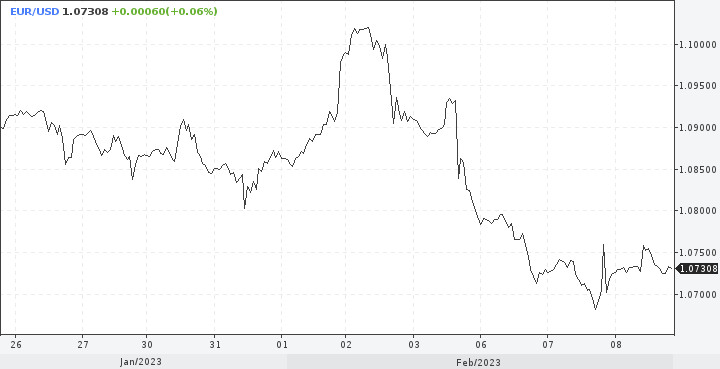

What about the euro

EUR/USD losses appear to be steadying around the 1.07 level. A break past the 1.0765/70 area could lift the pair to the 1.08 level, economists at Scotiabank report. The European Central Bank should provide support to the single currency.

"We think the relatively hawkish messaging from the ECB will serve to keep the EUR underpinned in the short run and that losses to the 1.07 area may provide an opportunity for bargain-hunters to step up to re-establish long positions that were squeezed out by the past week's volatility."

After a hike to 1.0800, a rebound to the January peak of 1.0940, which is expected to restrain the bulls from further pressure, is not excluded.

In this case, the immediate support is at 1.0680. Falling below this level will provide bears with the opportunity to sell in the direction of the January low at 1.0480. To begin with, they should be confident in the 1.0560 mark.