The EUR/USD currency pair gained nearly 300 pips between Wednesday and Thursday. We saw a repeat of the situation in early March when the U.S. dollar fell by 400 pips in just three days—although the current decline is even more intense. However, the exact magnitude of the fall doesn't matter. What's important is that the market once again responded clearly to how it views Donald Trump's tariffs. And that response was obvious: no one wants the dollar, the U.S. stock market is falling, and even Bitcoin is declining.

The market had been prepared for Trump to implement broad tariffs in the 10–15% range. But in reality, he not only imposed a 10% tariff on imports from all countries worldwide, he also compiled a list of nations that he believes treat the U.S. "most unfairly" and introduced individual tariffs for them. It's worth noting that while most countries will face a 10% tariff, some could see rates as high as 100%. Analysts have estimated that the average tariff across all affected countries is around 29%. China alone has received three separate sanction packages.

In truth, no other details matter. Trump stated that all the "sanctioned" countries need to do is eliminate all taxes and tariffs on U.S. exports and call the White House. From this perspective, he may appear to be acting reasonably—imposing tariffs on those countries that tax American goods in return. But for traders, fairness is irrelevant. And so it is for us. The entire world doesn't care anymore.

The European Union is preparing retaliatory measures. China, South Korea, and Japan are considering forming a trade alliance. As we've said, the major players on the geopolitical map will respond, while weaker ones will try to negotiate with the combative Trump. This new trade system will result in losses for all participants in the global market, one way or another. But Trump is unconcerned. He aims to replenish the national treasury and bring back factories and manufacturing to the U.S. His stance is simple: if you don't want to pay tariffs, produce goods in America. This would create jobs and boost the economy.

In other words, the U.S. is ready for an economic contraction, which will occur regardless, as relocating requires time. But will such a relocation occur? And will it happen at the scale Trump is counting on? Another key point is that a massive number of people around the world are now ready to boycott American goods. Previously, such sentiment mainly came from Canada, the EU, and a few other countries. But now, a widespread social media campaign under the hashtag "Boycott American" and plenty of supporters are gaining serious momentum.

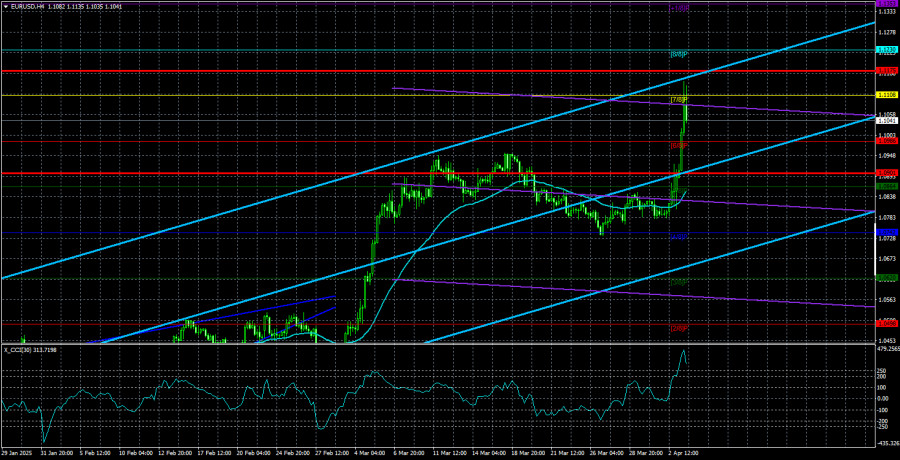

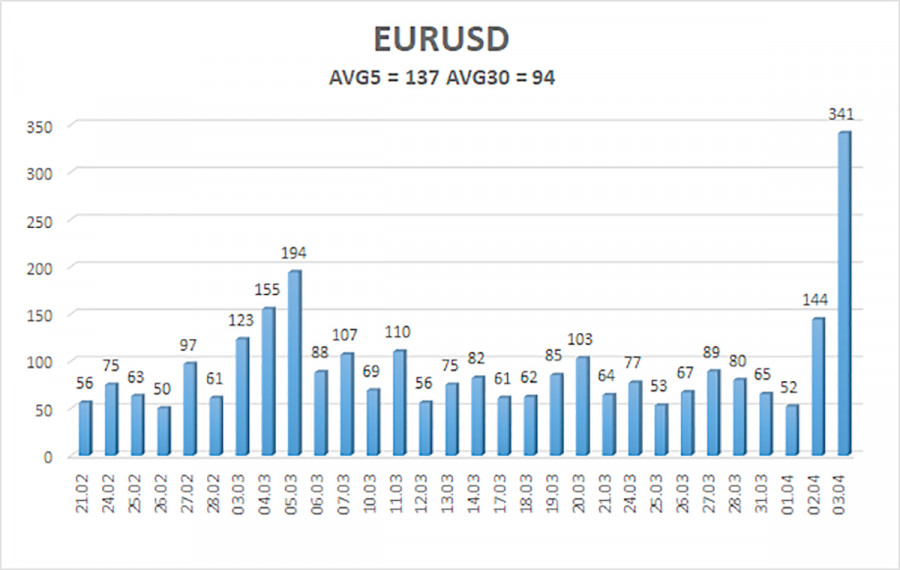

As of April 4, the average volatility of the EUR/USD pair over the past five trading days is 137 pips, which is considered "high." We expect the pair to move between the levels of 1.0901 and 1.1175 on Friday. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator entered overbought territory yesterday, suggesting a possible correction. However, the overall trend remains bullish.

Nearest Support Levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest Resistance Levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading Recommendations:

The EUR/USD pair continues its upward movement, which has become a trend. For several months, we've consistently said that we expect only a medium-term decline in the euro, and that view hasn't changed. The dollar still has no fundamental reason to weaken—except for Donald Trump. But that single factor continues to drive the dollar into freefall. This is an unprecedented and rare case for the currency market. Short positions still look attractive, with targets at 1.0315 and 1.0254, but it's currently very difficult to say when the "Trump-driven" rally will end. If you're trading purely on technicals, long positions may be considered if the price remains above the moving average, with targets at 1.1175 and 1.1230.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.