Among all the currencies included in the US dollar basket, the yen is the biggest underdog. The fundamental discrepancy between the US Federal Reserve's aggressive monetary policy and the Bank of Japan's ultra-soft monetary policy pushed the USD/JPY to 139 last week (139.9 high in September 1998). At the same time, the Japanese authorities have repeatedly expressed concern about the sharp depreciation of the yen, but there has never been any talk of any foreign exchange interventions, except for verbal ones. Meanwhile, in Japan itself, "enyasu" (weak yen) is beginning to be regarded as public enemy number one.

In addition to the policy of the BOJ, the movement of the yen is influenced by the yield of US government bonds. The safe-haven Japanese currency gets some tailwind even if the markets are risk-averse. Perhaps the recent strengthening of the yen is also due to the fact that speculation about a 100% rate hike by the US Federal Reserve has lost some supporters. Especially after several FOMC members at once made it clear that they would most likely prefer a 75 bp rate hike at the upcoming policy meeting on July 26-27. However, investors appear to be convinced that the recent spike in US inflation to a 40-year high will force the Fed to raise rates even further later this year.

With such conflicting prospects, and on elevated US Treasury yields, the dollar may try to reverse its recent corrective decline. And traders - to refrain from bearish rates on the yen. Especially amid expectations of the BOJ's decision. It is noteworthy that inflation data (consumer price index, CPI) will be published on July 22. That is, the decision of the central bank on the key rate will be released the day before.

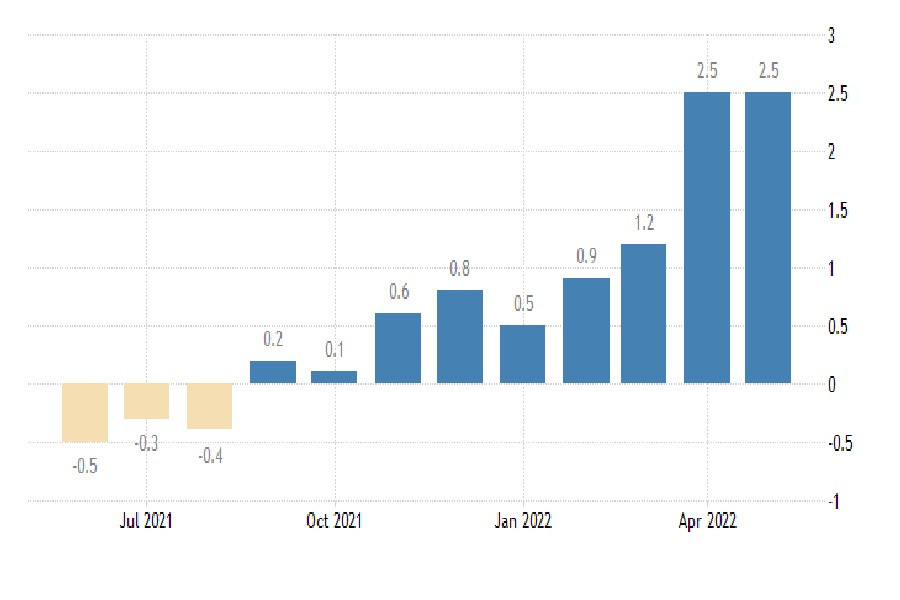

Consumer prices in Japan rise for the 10th consecutive month. In May 2022, the annual inflation rate was 2.5%, repeating the April data (7.5-year high).

Japanese Consumer Prices (May)

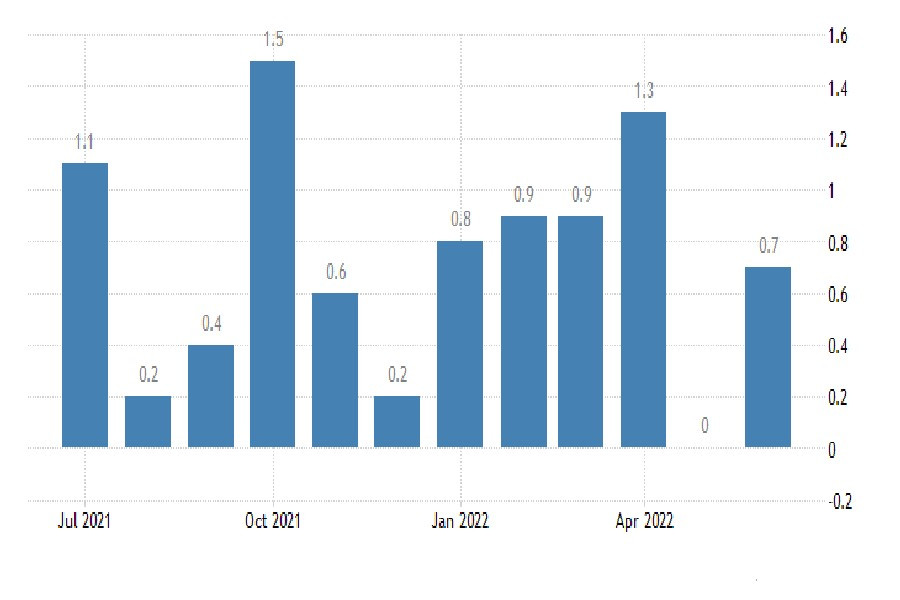

It is clear that those who will determine Japan's monetary policy in the near future have a certain idea of the state of prices. And they know that the inflationary background in the country is rising. So, for a month - from May to June - the producer price index increased from 0% to 0.70%.

Japanese Producer Price Change (M/M)

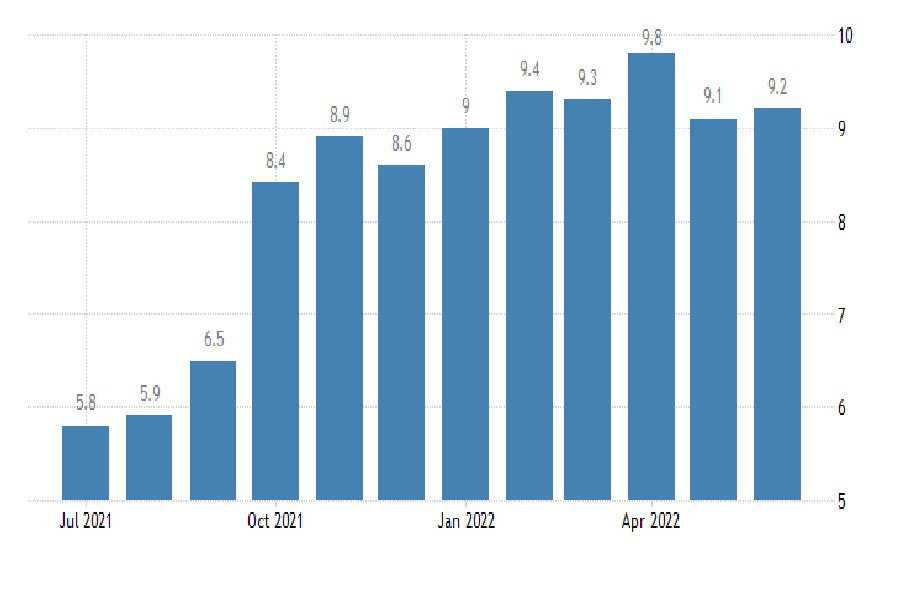

On an annualized basis, the PPI jumped to 9.2%. Moreover, the jump occurred mainly due to increased prices for raw materials and energy carriers, as well as an increase in import prices on the weak yen. The question "How will the increased production costs affect the price of the final product" looks rhetorical. It is clear that the business will shift part of its costs onto the shoulders of consumers.

Japanese Producer Price Change (Y/Y)

However, as the head of the BOJ, Haruhiko Kuroda, has repeatedly stated, the central bank intends to continue to adhere to the quantitative and qualitative easing (QQE) program with the control of the government bond yield curve. And the yen exchange rate, closely monitored by financial officials, may continue to fall for the time being. The fact that local inflation is somewhat above the target level of 2.0%, the BOJ explains the influence of external geopolitical and economic factors. So there will probably be no surprises and changes in the current dovish monetary policy. In turn, the Federal Open Market Committee (FOMC) is more willing to make hawkish decisions in the near future.

Since the key psychological level of 140 yen per dollar is already very close, analysts' views on the further path of the Japanese currency are beginning to diverge. Some of them (mainly in Japan) believe that the yen may still depreciate for some time, and that the BOJ still has some time to spare. Their arguments:

- It's too early to abandon dovish policy (BoJ Governor Haruhiko Kuroda);

- "A weaker yen is inevitable. There is room for a slight rise in the dollar/yen if US interest rates rise" (Takuya Kanada, general manager of the research institute Gaitame.com);

- "There are no obvious factors capable of strengthening the yen. There are still opportunities to sell the yen. Japan will be the only country with negative interest rates, and the yen will be the leading funding currency" (Tsuyoshi Ueno, NLI Research Institute);

- "There is still plenty of room to increase the selling position of the yen. A realistic goal is 160 per dollar." (Tatsuhiro Iwashige, Fivestar Asset Management Co.)

Bulls argue with the "bears" in Japan (mainly from abroad):

- "The difference in interest rates is a key factor in the poor performance of the yen. The spread between the five-year inflation-adjusted yields of U.S. and Japanese bonds has narrowed since the mid-June high, and this decline has yet to be repeated by the dollar/yen, which has tracked the difference throughout the year" (Geneva, Pictet Wealth Management);

- "A jump to 145 cannot be ruled out... But the bigger the rise, the bigger the fall" (Sydney, National Australia Bank Ltd.).

While analysts are breaking spears, the yen, which is indecisive today, is likely to dutifully go to new price highs against the US dollar. At the same time, short positions will prevail for the USD/JPY pair. And amid the strengthening of the dollar, the yen looks more and more undervalued.